As an insurance agent, you would think I have all of the insurance in the world. Right? Truthfully, no. I made a very painful mistake in not carrying coverage for my dogs. Even my wild child doggy who is like "Norm" from "Cheers!” when she walks into the vet’s office. She walks in the office and they yell "Pearl!" I do not know if that is a good or bad thing. You would think I would know better and carry coverage for my accident-prone canine. Recently my precious little girl cost us nearly $6,000 in one day! Guess what? There's insurance for that. Did I have any? Nope!

My sweet girl will eat anything she can get her mouth on. She is great with “Leave It” and “Drop” if we catch her in time. Otherwise, she will eat anything she can get her mouth on during our nightly walks or whenever the neighborhood kids accidentally drop a toy over our fence. Normally my husband will comment how our hound must be magical because of her “rainbow poo”, but recently something did not make it all the way through. It was a hard piece of plastic that caused ulcers in her stomach and was stuck in two different places. Of course, the doctors could not get it with a scope. She required surgery and a 2-day stay at the emergency hospital. She now has a nice huge zipper up her entire abdomen and a worried mama

After two sleepless nights, we finally got my princess home! Now I just have to figure out how to tell my husband that I could have bought an insurance policy to cover her vet bills, but I did not purchase it. And I have to tell him our dreams of a new kitchen have been put on hold for a bit.

I quoted some insurance for Pearl today. If we paid $44.47 a month, I could have had $10,000 annual-limit of coverage for her. The deductible would be $250 and the policy would have paid a reimbursement of 90%.

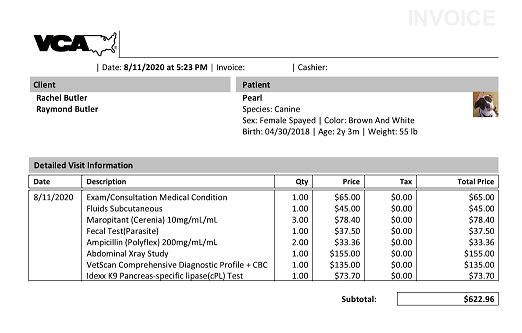

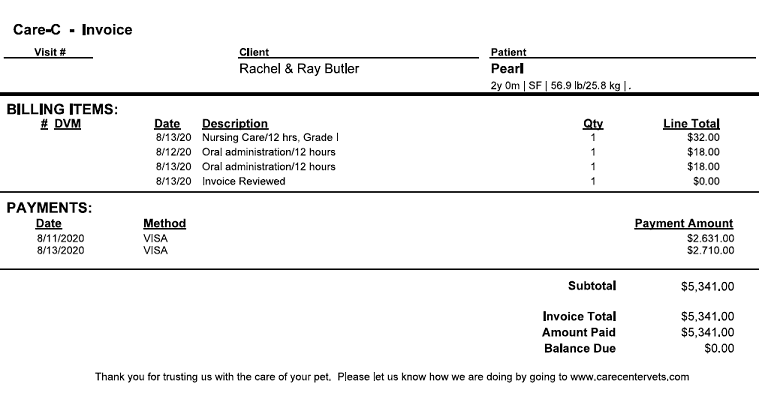

My two bills (regular vet and emergency vet) were $622.96 and $5,341.00 = $5,963.96.

$5,963.96 - $250 deductible = $5,713.96

$5,713.96 x 90% = $5,142.57. This is how much money I could have in my pocket still, if I purchased the insurance!

Take a lesson from me. Do not wait to talk to us about insurance for your pet! If you would rather do it yourself, you can get a quote and buy it online today! https://www.ekagency.com/pet_insurance/quote.aspx

Here is a cute picture from her puppy days!