Many times we receive the question, "Why is my auto insurance more expensive than my neighbors or friends?" There are many different factors that go into insurance rates and no one is exactly the same. Here are just a few of the components of auto insurance rating.

Insurance score- Each company has their own way to calculate your insurance score, but most follow this method. They calculate your score from information on your credit report, accident, and insurance claim history. With this information they form an “insurance score” which helps the company predict how likely you are to have a future accident or claim.

Some positive credit factors are: An established credit history, numerous open accounts that are in good standing, no late or past due accounts and low use of available credit. If you have accounts in collections, accounts that are past due, several recent credit applications or high use of credit, this can affect your score negatively.

Your age plays a role in your auto insurance premium. Each company has their own rating system for age of drivers, but you should see a break in premium once you turn 25. You are no longer considered a “youthful” at 25 and are more experienced.

Do you have any speeding tickets? Motor vehicle violations and claims will cause your premiums to increase. This is because you are showing the company that you pose a higher risk. Some companies will only look at 3 years of violations and claims, but most will look at the past 5 years of your driving experience.

Owning your home can offer a discount on your auto insurance. Insurance companies look at homeowners as being more stable.

Has your agent ever asked about your occupation or education? Both of these can offer additional discounts on your auto policy. You can receive discounts for “professional” careers such as the education and medical industry and for higher education. If you have a graduate or post-graduate degree, make sure you mention that to your agent!

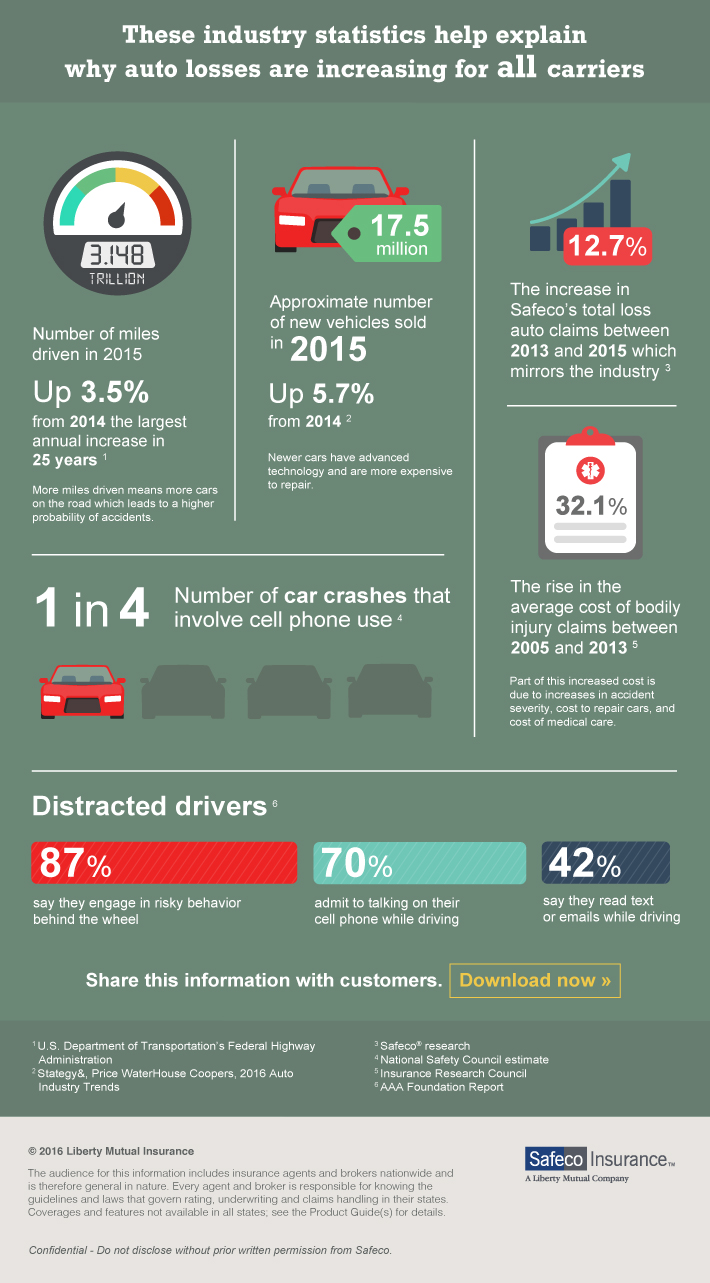

Your vehicle can determine how much you are paying for insurance as well.

- Age – Newer cars may receive a new car discount, but being new the parts to repair are often more expensive.

- Make – Many times the make of a car can cost more to insure because, there are less body shops available to work on them and the parts are not readily available.

- Model – The “high-end” models can cause your premium to increase, because there are more bells and whistles to get damaged in an accident.

- Safety Features – Airbags and blind spot monitoring will offer a discount on your vehicles premium, but these safety features can also be expensive to replace or repair.

- Alarm – Car alarms can offer money saving discounts as well.

- Coverage – The more coverage you have, the more your premium could be. Be sure to protect you and your family long-term with the appropriate coverage. Don’t think “cheap” think about protection.

- Multi vehicle – When you have more than one vehicle on your policy you will receive a multi-vehicle discount. Be sure to mention if your partner or spouse has a company vehicle. This many qualify you for the multi-vehicle discount.

As you can see, there are MANY factors that go into your insurance rate. Each company will factor these items differently so having an independent agent run your information through several companies offers you the best chance at the best premium with the best coverage.

Sources:

16 Discounts to ask your agent about

Progressive Car Insurance Credit Score

What affects the cost of car insurance

Safeco